by

Jen Novotny

| Feb 05, 2020

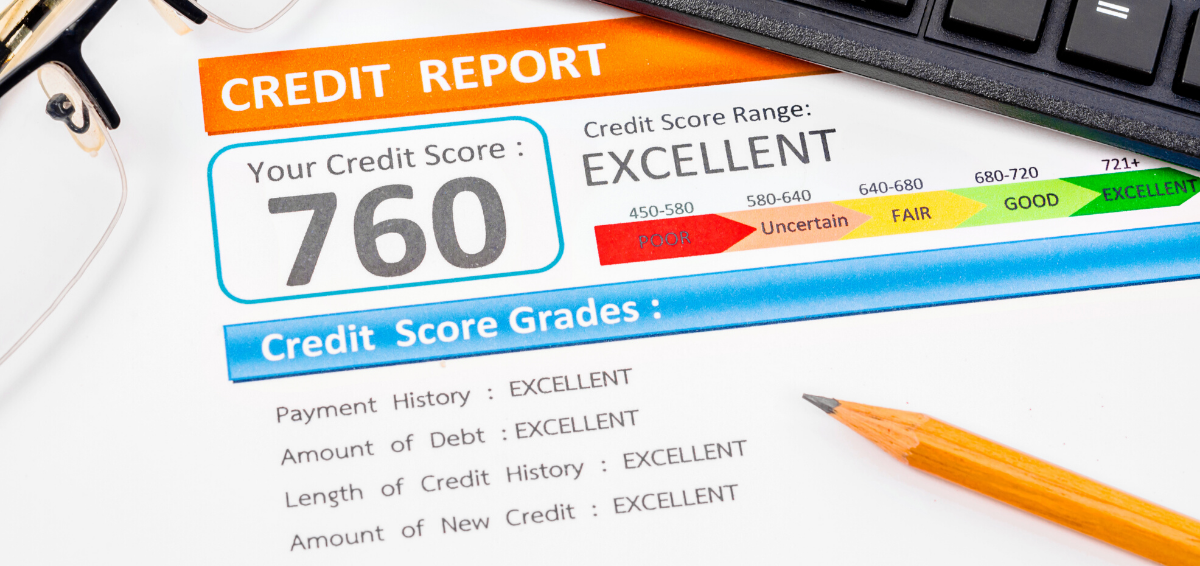

Having good credit is key to a strong financial foundation, so it’s important to build a record of responsible credit practices that demonstrate sound money management. It’s much easier to build a credit score than repair a damaged one.

Forte Bank and the Independent Community Bankers of America® (ICBA) offer the following tips to help you build and maintain good credit and avoid costly missteps.

- If you are just beginning to establish your credit history, open a checking account and keep careful track of your balance.

- Use debit and credit cards for convenience and safety, but not to overspend. Missed or late payments damage your credit and hurt your credit score.

- A good mix of credit (such as a revolving credit line and an installment loan) also boosts your credit score and further shows that you can manage different types of credit.

- Demonstrate stability in the 3-6 months before a major purchase. Avoid opening or closing accounts or moving large amounts of money around.

- Build an emergency fund equal to at least six months of living expenses. This way, if you have something unexpected happen you will still be able to pay fixed expenses instead of falling behind.

- Alter your credit focus as you approach different stages in your life. As you near retirement, for example, start paying down major purchases, such as a mortgage.

- Monitor your credit regularly so you can correct any errors and detect any potential signs of identity theft. Order a free copy of your credit report annually from www.annualcreditreport.com.

Maintaining good spending and saving habits early can help you maintain your financial goals and navigate life’s unexpected twists and turns.

If you have questions about your credit, speak with one of our universal bankers today.

About ICBA

The Independent Community Bankers of America® creates and promotes an environment where community banks flourish. With more than 50,000 locations nationwide, community banks constitute 99 percent of all banks, employ nearly 750,000 Americans and are the only physical banking presence in one in three U.S. counties. Holding more than $5 trillion in assets, nearly $4 trillion in deposits, and more than $3.4 trillion in loans to consumers, small businesses and the agricultural community, community banks channel local deposits into the Main Streets and neighborhoods they serve, spurring job creation, fostering innovation and fueling their customers’ dreams in communities throughout America. For more information, visit ICBA’s website at www.icba.org.